Financial Planning Tips for Smart Investors

In today’s fast-paced financial world, being a smart investor is more than just picking the right stocks or mutual funds. True financial success comes from disciplined, strategic financial planning. Whether you’re a seasoned investor or just beginning your investment journey, effective planning can make a significant difference in achieving your financial goals. In this comprehensive guide, we’ll explore the most effective financial planning tips for smart investors to help you build wealth, manage risks, and secure a financially stable future.

Understanding the Importance of Financial Planning

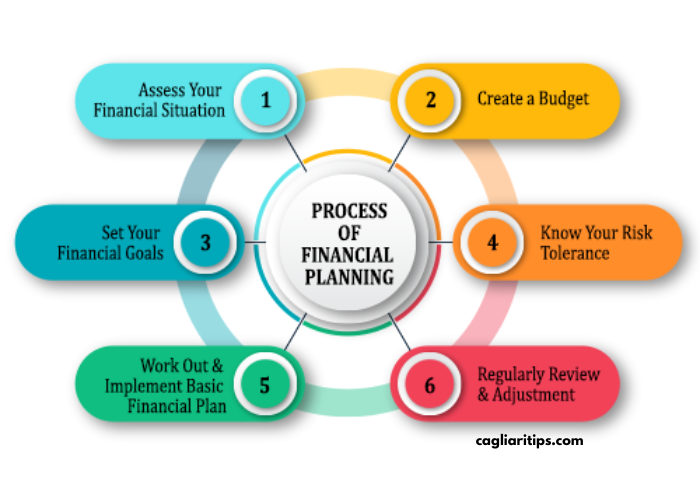

Financial planning is the foundation of smart investing. It’s the process of defining your financial goals, creating strategies to achieve them, and monitoring your progress over time. Without a clear plan, even the most lucrative investment opportunities may not lead to long-term success.

Key Benefits of Financial Planning

-

Goal-oriented investing: Helps you set realistic financial goals and create a roadmap to reach them.

-

Risk management: Protects you from unforeseen market fluctuations and economic downturns.

-

Better decision-making: Empowers you to make informed, strategic financial choices.

-

Financial security: Ensures a secure future for retirement, education, emergencies, and more.

Step-by-Step Financial Planning Tips for Smart Investors

1. Set Clear and Realistic Financial Goals

Start with the “why” of your investments. Are you saving for retirement? A child’s education? Buying a home? Investing without a goal is like sailing without a compass.

Tips:

-

Divide your goals into short-term (1–3 years), medium-term (3–7 years), and long-term (7+ years).

-

Quantify your goals (e.g., $50,000 for a down payment in 5 years).

-

Set timelines and review your goals annually.

2. Create a Monthly Budget and Stick to It

A smart investor understands cash flow. Budgeting gives you control over your income and expenses, helping you identify how much you can realistically invest.

Tips:

-

Use the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings and investments.

-

Track every dollar using budgeting apps like YNAB or Mint.

-

Avoid lifestyle inflation as your income grows.

3. Build an Emergency Fund First

Before diving into investments, ensure you have a safety net. An emergency fund shields you from having to liquidate investments during tough times.

Tips:

-

Aim for 3–6 months of living expenses in a liquid savings account.

-

Keep this fund separate from your regular account.

-

Replenish it if used for emergencies.

Smart Investment Strategies for Every Investor

4. Diversify Your Investment Portfolio

One of the golden rules of investing: don’t put all your eggs in one basket. Diversification spreads risk and increases potential returns.

Tips:

-

Mix assets like stocks, bonds, real estate, and mutual funds.

-

Diversify across industries and geographies.

-

Rebalance your portfolio annually.

5. Understand Your Risk Tolerance

Investing isn’t one-size-fits-all. Your age, income, family situation, and financial goals impact how much risk you can or should take.

Tips:

-

Use online risk tolerance questionnaires.

-

Young investors can typically afford higher-risk investments.

-

Reassess risk tolerance after major life changes.

6. Invest for the Long Term

Short-term trading is risky and often driven by emotion. A smart investor thinks long term.

Tips:

-

Avoid timing the market; instead, time in the market.

-

Choose long-term investments like index funds or blue-chip stocks.

-

Compound interest works best over years, not days.

Tax Planning: A Crucial Part of Financial Planning

7. Optimize Your Taxes

Many investors ignore tax planning, which can lead to paying more than necessary. Strategic tax planning increases your net returns.

Tips:

-

Use tax-advantaged accounts (e.g., IRAs, 401(k), Roth IRA).

-

Offset capital gains with capital losses (tax-loss harvesting).

-

Consult with a tax advisor for personalized advice.

Retirement Planning for Smart Investors

8. Start Early with Retirement Savings

The earlier you start, the more time your money has to grow. Delaying retirement planning can result in having to save much more later in life.

Tips:

-

Open and contribute to retirement accounts early.

-

Take advantage of employer matches.

-

Calculate how much you’ll need to retire comfortably.

9. Review and Adjust Retirement Plans Regularly

Markets, expenses, and personal situations change. Regular check-ins keep your retirement strategy on track.

Tips:

-

Review plans annually or after major life events.

-

Adjust contributions as income increases.

-

Use retirement calculators to assess progress.

Managing Debt Effectively

10. Pay Down High-Interest Debt Quickly

Debt can severely impact your ability to invest and build wealth. Particularly, high-interest consumer debt like credit cards can drain your finances.

Tips:

-

Use the snowball or avalanche method to pay down debt.

-

Refinance loans if you can get a better rate.

-

Avoid taking on new debt unless absolutely necessary.

11. Balance Investing and Debt Repayment

While paying off debt is important, sometimes investing early—especially in tax-advantaged or employer-matched accounts—can yield better long-term returns.

Tips:

-

Prioritize high-interest debt first.

-

Simultaneously invest a portion in retirement or long-term plans.

-

Work with a financial advisor for a balanced approach.

Regularly Monitor and Adjust Your Financial Plan

12. Track Your Net Worth

Your net worth—assets minus liabilities—gives a clear picture of your financial health.

Tips:

-

Update your net worth quarterly.

-

Use personal finance software like Personal Capital or Excel sheets.

-

Celebrate milestones to stay motivated.

13. Stay Informed and Educated

Smart investors stay sharp. Financial literacy helps you make better choices, avoid scams, and seize new opportunities.

Tips:

-

Read investment books and financial news.

-

Take online courses or attend webinars.

-

Follow trusted finance blogs and podcasts.

Avoid Common Financial Planning Mistakes

14. Don’t Let Emotions Drive Financial Decisions

Markets fluctuate—sometimes wildly. Emotional decisions often lead to losses.

Tips:

-

Stick to your plan during downturns.

-

Avoid panic selling or euphoric buying.

-

Automate investments to stay consistent.

15. Beware of “Too Good to Be True” Schemes

If it sounds too good to be true, it probably is. Scammers prey on uninformed investors with promises of guaranteed returns.

Tips:

-

Research thoroughly before investing.

-

Check if the investment is registered with regulatory bodies.

-

Avoid putting large sums into high-risk, unregulated ventures.

Work with Professionals When Needed

16. Hire a Certified Financial Planner (CFP)

Sometimes, a professional touch is worth the cost. CFPs bring expertise, objectivity, and experience to your financial life.

Tips:

-

Ensure your planner is fiduciary—legally obligated to act in your best interest.

-

Ask about their fee structure—hourly, flat, or commission-based.

-

Use them for big financial decisions, estate planning, and retirement planning.

17. Regular Financial Health Check-Ups

Just like your physical health, your finances need regular assessments.

Tips:

-

Conduct a full financial review every 6–12 months.

-

Re-evaluate goals, budgets, and risk tolerance.

-

Adjust your plan to stay aligned with current market trends.

Smart Tech Tools for Financial Planning

18. Leverage Fintech for Better Control

Today, a wide range of apps and tools make it easier than ever to manage finances, invest smartly, and plan ahead.

Popular Tools:

-

Budgeting: Mint, YNAB, PocketGuard

-

Investing: Robinhood, Wealthfront, M1 Finance

-

Retirement: Blooom, Betterment

-

Net Worth Tracking: Personal Capital, Empower

Final Thoughts: The Journey to Smart Investing

Financial planning is not a one-time activity—it’s a lifelong process. Smart investors are proactive, patient, and persistent. They plan well, learn continuously, and adapt to life’s changes while keeping their eyes on long-term goals.

The earlier you start, the better off you’ll be. But even if you feel late to the game, it’s never too late to start. Use the tips above to build a solid foundation, protect your wealth, and unlock long-term financial success.

Frequently Asked Questions (FAQs)

Q1: What is the most important aspect of financial planning?

The most crucial aspect is setting clear, measurable, and achievable financial goals. Without goals, it’s hard to create a roadmap or measure progress.

Q2: How often should I update my financial plan?

Ideally, you should review your financial plan annually, or whenever a major life change occurs—like marriage, childbirth, job change, or inheritance.

Q3: Can I start financial planning with a small income?

Absolutely. Financial planning is not about how much you make but how well you manage what you have. Budgeting, saving, and investing can all be started with small amounts.

Q4: Is it better to save money or invest it?

Both are important. Saving helps with liquidity and emergencies; investing helps grow wealth over the long term. A balanced approach is ideal.